Best Travel Credit Cards in 2025: Top Rewards, Perks & Expert Picks

Traveling should be about creating memories, not stressing over expenses! Did you know that the average traveler leaves behind approximately $700 in potential travel rewards each year by using the wrong credit card? I’ve spent years analyzing travel credit cards and their evolving benefits, and I’m excited to share the absolute best options for 2025.

Quick Overview: Best Travel Rewards credit Cards by Category

Before diving into the details, here’s a quick reference guide to the top travel credit cards for 2025 by category:

| Best Overall Travel Card | Chase Sapphire Reserve |

| Best Premium Card for Luxury Benefits | The Platinum Card from American Express |

| Best Mid-Tier Travel Card | Chase Sapphire Preferred |

| Best for Dining & Travel Combo | American Express Gold Card |

| Best No Annual Fee Travel Card | Capital One VentureOne |

| Best for Hotel Stays | World of Hyatt Credit Card |

| Best for Airline Rewards | Citi AAdvantage Executive World Elite Mastercard |

| Best for Road Trips | Costco Anywhere Visa by Citi |

| Best for International Travel | Capital One Venture X |

| Best for Beginners | Bank of America Travel Rewards |

| Best for Flexible Redemptions | Citi Premier Card |

| Best for Airport Lounge Access | American Express Platinum Card |

| Best for Travel Credits | U.S. Bank Altitude Reserve Visa Infinite Card |

Whether you’re a frequent flyer or occasional vacationer, the right travel credit card can transform your experience—unlocking free flights, hotel stays, airport lounge access, and protection against those inevitable travel hiccups. In this comprehensive guide, we’ll explore the top travel credit cards that deserve a spot in your wallet this year.

What Makes a Great Travel Credit Card?

Not all travel credit cards are created equal. The best ones offer a combination of generous rewards, valuable perks, and sensible fees that align with your specific travel habits and goals.

The hallmark of exceptional travel cards is their ability to earn points or miles at an accelerated rate on travel-related purchases. While standard credit cards might offer 1% back on spending, top travel cards deliver 2-5x points on categories like airfare, hotels, dining, and transportation. This multiplier effect is what separates travel enthusiasts from those leaving rewards on the table.

When evaluating annual fees, it’s crucial to look beyond the sticker shock. A $550 annual fee might seem steep initially, but if the card delivers $750+ in annual credits and perks you’ll actually use, it becomes a mathematical no-brainer. I always recommend calculating your “net annual fee” by subtracting the value of guaranteed benefits you’ll use.

The flexibility of a card’s rewards program often determines its long-term value. Programs that allow points transfers to multiple airlines and hotels (like Chase Ultimate Rewards or American Express Membership Rewards) typically offer more redemption options and better value potential than cards locked into a single airline or hotel program. However, if you’re loyal to a specific brand, a co-branded card might deliver specialized benefits that a general travel card cannot.

Comprehensive travel protections are increasingly important in today’s unpredictable travel landscape. Premium travel cards now include benefits like trip cancellation/interruption insurance, delayed baggage reimbursement, rental car coverage, and even emergency evacuation insurance. These protections can save thousands when travel plans go awry.

Welcome bonuses deserve careful consideration but shouldn’t be the sole deciding factor. While a flashy 100,000-point offer might turn heads, evaluate whether the spending requirement is realistic for your budget and if the ongoing benefits justify keeping the card beyond year one.

Best Premium Travel Credit Cards

Premium travel cards, typically carrying annual fees of $450 or more, deliver luxury travel experiences and outsized value for frequent travelers who can maximize their benefits.

The Chase Sapphire Reserve continues to reign as a powerhouse premium option in 2025, with its $550 annual fee offset by a $300 annual travel credit that automatically applies to a broad range of travel purchases. Cardholders earn 3x points on travel (after using the travel credit) and dining worldwide, with points worth 50% more when redeemed through Chase’s travel portal. What sets this card apart is its exceptional travel protection suite and the ability to transfer points to 14 airline and hotel partners at a 1:1 ratio.

The Platinum Card from American Express ($695 annual fee) focuses less on earning rates and more on premium travel privileges. The extensive airport lounge network is unmatched, with access to Centurion Lounges (including the newest locations in Nashville and Denver), Priority Pass lounges, Delta SkyClubs (when flying Delta), and more. With up to $1,500 in annual statement credits across categories including hotel bookings, airline incidentals, digital entertainment, and Uber rides, devoted users can extract tremendous value despite the hefty annual fee.

Capital One’s Venture X ($395 annual fee) represents the newest entrant in the premium space, offering 10x miles on hotels and rental cars booked through Capital One Travel, 5x on flights, and 2x on everything else. The annual $300 travel credit and 10,000-mile anniversary bonus effectively reduce the fee to $95 or less for most users. Access to Capital One Lounges (currently in Dallas, with New York and Denver locations opening in 2025) and Priority Pass provides a comprehensive airport experience.

For luxury hotel experiences, the Hilton Honors American Express Aspire Card delivers automatic top-tier Diamond status, an annual free weekend night certificate, and $250 in airline incidental credits for its $450 annual fee. Meanwhile, the Marriott Bonvoy Brilliant American Express Card offers Platinum Elite status, an annual free night certificate worth up to 85,000 points, and $300 in Marriott credits annually.

The concierge services offered by these premium cards go beyond booking reservations. In 2025, we’re seeing more personalized trip planning assistance, access to exclusive events (like American Express’s By Invitation Only experiences), and dedicated travel specialists who can arrange custom itineraries. For travelers who value their time, these services represent significant hidden value.

Best Mid-Tier Travel Credit Cards

Mid-tier travel cards ($95-250 annual fee range) often deliver the best value proposition for casual and semi-frequent travelers, offering premium benefits without premium prices.

The Chase Sapphire Preferred ($95 annual fee) remains the benchmark in this category, offering 3x points on dining and 2x on travel worldwide. The 25% boost in point value when redeeming through Chase’s travel portal and the annual $50 hotel credit through Chase Travel make this card a perpetual favorite. The recently added bonus categories (3x on online grocery purchases and select streaming services) have made this card more valuable for everyday spending.

American Express Gold Card ($250 annual fee) excels for travelers who also value dining rewards, earning 4x points at restaurants worldwide and 3x on flights booked directly with airlines. The $120 in annual dining credits ($10 monthly at participating partners) and $120 in Uber Cash ($10 monthly for Uber rides or Uber Eats) effectively reduce the annual fee for regular users of these services.

Citi Premier ($95 annual fee) offers one of the most diverse category bonus structures, with 3x points on air travel, hotels, restaurants, supermarkets, and gas stations. The annual $100 hotel savings benefit (on single hotel stays of $500+) and ability to transfer points to 16 airline partners make this an underrated option for travelers seeking flexibility.

For brand loyalists, the World of Hyatt Credit Card ($95 annual fee) delivers exceptional value with its annual free night certificate at Category 1-4 properties, automatic Discoverist status, and the ability to earn higher elite status through spending. Similarly, the Delta SkyMiles Gold American Express Card‘s first checked bag free benefit (for you and up to 8 companions) can save a family of four $240 on a single roundtrip flight.

The true strength of mid-tier cards lies in their transfer partner opportunities. For example, transferring Chase Ultimate Rewards points to World of Hyatt can yield values of 2-3 cents per point at luxury properties, far exceeding the baseline redemption value. Similarly, Citi ThankYou points transferred to Turkish Airlines Miles&Smiles can book domestic United flights for just 7,500 miles each way in economy—a tremendous value that savvy travelers exploit regularly.

Best No-Annual-Fee Travel Credit Cards

No-annual-fee travel cards provide an accessible entry point to travel rewards without financial commitment, making them ideal for beginners, occasional travelers, or as complementary cards in a broader strategy.

The Capital One VentureOne stands out with unlimited 1.25x miles on all purchases, no foreign transaction fees, and the ability to transfer miles to the same airline and hotel partners as premium Capital One cards. While the earning rate is modest, the flexibility of redemption options makes this a solid foundation card.

Bank of America Travel Rewards offers 1.5 points per dollar on all purchases with no foreign transaction fees. What sets this card apart is the potential for relationship bonuses—Bank of America Preferred Rewards members can earn up to 75% more points on every purchase, boosting the effective earning rate to 2.62 points per dollar for Platinum Honors tier members with significant bank balances.

For travelers focused on specific brands, the Hilton Honors American Express Card delivers surprising value with no annual fee. Cardholders enjoy automatic Silver status, 7x points at Hilton properties, and 5x points at U.S. restaurants, U.S. supermarkets, and U.S. gas stations. Similarly, the United Gateway Card offers 2x miles on United purchases, gas stations, and local transit, with the valuable addition of expanded award availability.

The complete absence of foreign transaction fees is particularly noteworthy in this category, as many no-annual-fee cards charge 3% on international purchases. This feature alone can save hundreds on a lengthy international trip and makes these cards worth considering even for travelers with premium options.

No-annual-fee cards also frequently offer attractive 0% APR periods on purchases and balance transfers. The Discover it Miles provides a 0% intro APR on purchases for 15 months (then 18.74% to 29.74% Variable APR), plus unlimited 1.5x miles on all purchases with no foreign transaction fees. Discover’s unique first-year mile matching effectively doubles your earnings for the initial year.

When paired strategically with premium cards, no-annual-fee options can fill category gaps or serve as long-term credit history builders that help maintain a strong credit profile without ongoing costs.

Specialized Travel Credit Cards Worth Considering

Certain travel scenarios call for specialized cards that excel in specific niches rather than trying to be all-things-to-all-travelers.

For dedicated airline travelers, the Citi AAdvantage Executive World Elite Mastercard justifies its $450 annual fee with Admirals Club membership (worth $650+ for individual membership) and privileges that enhance the American Airlines experience, including priority check-in, security, and boarding.

Delta loyalists might prefer the Delta SkyMiles Reserve American Express Card, which offers companion certificates valid even on first-class domestic flights and complimentary upgrades for non-status members.

Hotel enthusiasts should consider the IHG One Rewards Premier Credit Card, which provides automatic Platinum Elite status, a free night certificate annually, and a unique fourth night free benefit on award stays. The free night alone can easily exceed the $99 annual fee when used at properties like the InterContinental San Francisco or Hotel Indigo Bangkok.

International travelers face unique challenges that specialized cards address. The HSBC Premier World Elite Mastercard eliminates foreign transaction fees while adding benefits like $100 annual air travel credit, complimentary LoungeKey airport lounge access, and no foreign transaction fees. Its Global View feature allows seamless movement of funds between HSBC accounts in different countries—invaluable for expatriates or frequent international travelers.

Road trip enthusiasts might prioritize cards like the Costco Anywhere Visa by Citi, offering 4% cash back on eligible gas purchases worldwide (up to $7,000 annually), 3% on restaurants and eligible travel, and 2% on all Costco purchases. The lack of foreign transaction fees makes this useful beyond U.S. borders as well.

The emerging trend of vacation rental accommodations is addressed by cards like the Bilt Mastercard, which allows fee-free rent payments that earn points transferable to travel partners—a game-changer for renters. Its points can be used for Airbnb stays through the travel portal or transferred to partners like Hyatt for vacation rental redemptions through their home sharing platform.

How to Maximize Travel Credit Card Rewards

Strategic optimization transforms good travel cards into extraordinary value engines. Beyond simply using the right card for the right purchase, true maximization requires systematic planning and execution.

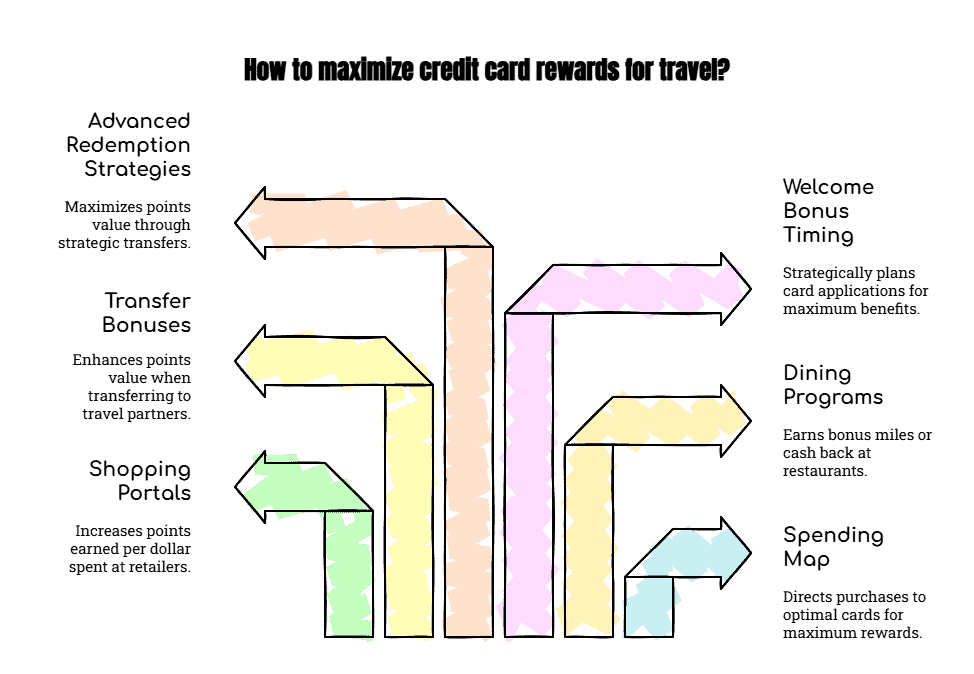

Start by creating a spending map that directs different purchase types to their optimal cards—dining on your 4x points card, groceries on your 3% cash back card, and general purchases on your 2x flat-rate card. Digital wallet technology makes this easier than ever, allowing you to preset different cards for different merchant categories.

Shopping portals multiply your rewards significantly when used consistently. Before purchasing online, routing through your credit card’s shopping portal (like Chase Ultimate Rewards Shop Through Chase or AmEx’s Membership Rewards Shop) can add 2-15x additional points per dollar spent at thousands of retailers. Similarly, airline shopping portals like United MileagePlus Shopping and Southwest Rapid Rewards Shopping extend your earning beyond the baseline card rate.

Dining programs operate on the same principle—registering your cards with programs like Rakuten Dining, United MileagePlus Dining, or AAdvantage Dining allows you to earn bonus miles or cash back in addition to your regular card rewards when eating at participating restaurants. Since these programs stack with your credit card rewards, the combined return can exceed 10% on dining expenditures.

Timing is critical for capturing transfer bonuses—temporary promotions where credit card points transfer to travel partners at enhanced ratios. For example, American Express frequently offers 30% bonuses when transferring to Virgin Atlantic, potentially increasing your effective points value by a third. Setting calendar alerts for historical bonus periods (often quarterly) helps capture these opportunities.

Welcome bonus timing requires strategic planning in 2025. With many issuers implementing increasingly strict application rules (such as Chase’s 5/24 policy and American Express’s once-per-lifetime bonus restriction), sequence matters. Generally, prioritize applications for cards with the most restrictive policies first, then move to more flexible issuers.

Advanced redemption strategies deliver exponentially greater value than basic ones. While using points for statement credits typically yields about 1 cent per point, strategic transfers to airline partners for business or first-class international flights can deliver 5-10 cents per point in value. For example, transferring 85,000 Chase Ultimate Rewards points to Virgin Atlantic to book a Delta One business class flight to Europe (which might cost $4,000+) represents tremendous value multiplication.

Common Travel Credit Card Mistakes to Avoid

Even sophisticated travelers make costly mistakes that undermine their rewards strategy. Awareness of these pitfalls is the first step toward avoiding them.

Carrying balances on rewards cards fundamentally changes the math on their value proposition. With interest rates averaging over 20% APR in 2025, even one month of interest charges can negate an entire year’s worth of rewards value. Travel rewards cards should be viewed as payment vehicles, not financing tools—if you need to carry a balance, transfer it to a dedicated 0% APR card while continuing to use your rewards cards for new purchases that you can pay in full.

Oversight of statement credits represents billions in unclaimed value annually. Many premium cardholders fail to utilize their airline incidental credits, hotel credits, or lifestyle benefits before they expire. Setting calendar reminders for quarterly or semi-annual reviews ensures you’re extracting every dollar of value from your annual fees.

Point valuation errors lead many travelers to redeem for sub-optimal options. Using valuable transferable points for merchandise, gift cards, or statement credits often delivers half the value (or less) compared to strategic travel redemptions. Before redeeming, compare the cents-per-point value against benchmark standards—Chase and AmEx points should generally deliver at least 1.5-2 cents per point in value, or you’re leaving money on the table.

Card closure decisions require careful analysis of ripple effects. Closing cards without considering point forfeiture risks, average age of accounts impact on credit scores, and utilization ratio changes can have unintended consequences. When annual fees come due, consider downgrading to no-annual-fee versions rather than outright closure to preserve credit history and any accumulated points.

Benefit activation oversight is particularly common with travel protection benefits. Many travelers fail to charge their entire trip to the card offering premium protections, inadvertently disqualifying themselves from coverage when problems arise. Similarly, failing to register for priority boarding, checked bag benefits, or companion certificates means paying for benefits you’ve already earned through your card membership.

Conclusion

Choosing the best travel credit card in 2025 ultimately depends on your specific travel habits, spending patterns, and reward preferences. By carefully analyzing the benefits, fees, and reward structures of the cards we’ve highlighted, you can make an informed decision that elevates your travel experiences while maximizing your savings.

For frequent international travelers seeking premium experiences, cards like the Chase Sapphire Reserve and American Express Platinum deliver exceptional lounge access, travel protections, and flexible rewards that justify their substantial annual fees. Mid-tier travelers might find greater value in the Chase Sapphire Preferred or Citi Premier, with manageable annual fees offset by substantial ongoing benefits and transfer options. Occasional travelers or those just beginning their rewards journey can build solid foundations with no-annual-fee options like the Capital One VentureOne or Bank of America Travel Rewards.

Remember that the ideal strategy often involves combining complementary cards to create a powerful rewards system rather than relying on a single “perfect” card. By using specialized cards for their category strengths and core cards for everyday spending, you can maximize returns across your entire spending profile.

As travel patterns and card offerings continue to evolve throughout 2025, stay attuned to changes in benefit structures, transfer partnerships, and promotional opportunities. The travel rewards landscape rewards those who remain informed and adaptable in their approach.

Ready to transform your travel experience? Start by applying for the card that best aligns with your travel goals and prepare for adventures with added perks and savings. Your next journey isn’t just about the destination—it’s about how intelligently you get there.